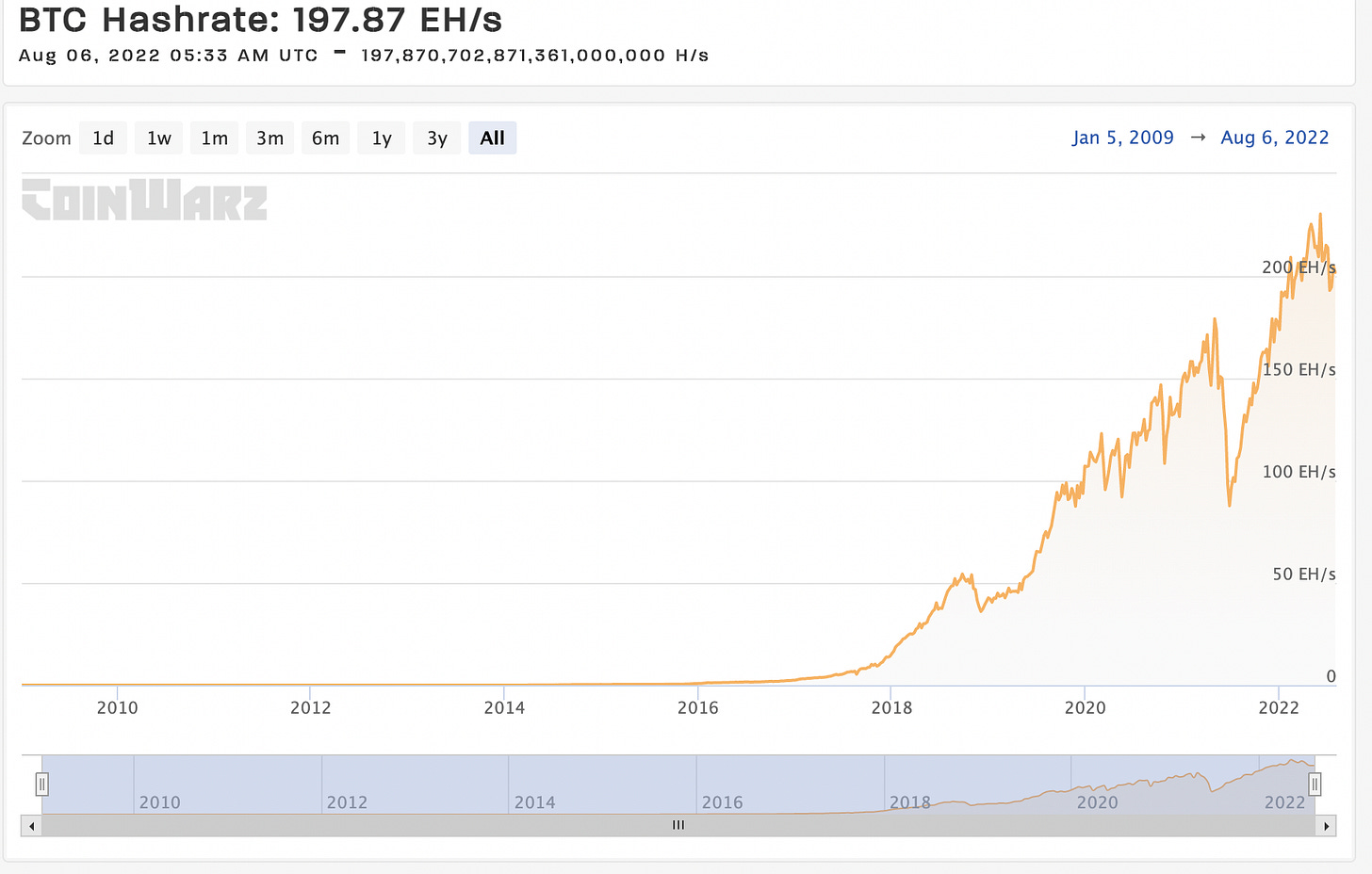

The cumulative hash rate of bitcoin miners has followed an uptrend since inception. Sometimes there were periods of several months in which it decreased, but over long periods the hash rate consistently increased (see graph). This attests of many factors like mining rigs becoming more powerful and miners becoming consistently more astute at getting cheap energy.

Now we see that miners can make money too, by not mining bitcoin.

A recent Bloomberg article states “bitcoin miners are adding resiliency to energy grids by acting as demand response entities that shut off when the grid is strained. RIOT Mining is contracted to curtail its operations when demand for energy is high and supply is tight. This allows them to sell capacity back into the grid instead of mining Bitcoin. This is exactly what occurred during the month of July. RIOT’s machines only had 79% uptime during the month of July, but they earned more money while their machines were down.”

Jason Les, CEO of RIOT said, “When applied to anticipated power costs for the month, the power credits and other benefits are expected to effectively eliminate Riot’s power costs for July, further enhancing the Company’s industry-leading financial strength amid a challenging macroeconomic environment for the industry.”

You can learn more about this subject in this thread.